$363,142 Questions

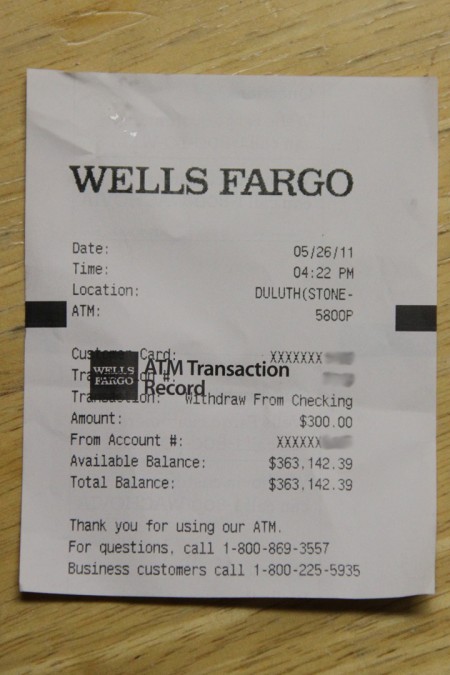

I was at Cub Foods tonight, bagging up my groceries, when I spotted the ATM at the Wells Fargo branch and decided to withdraw some cash. As I waited for the transaction to go through, I glanced at a stray ATM receipt sitting atop the machine. And boy, was it more interesting than I expected:

A withdrawal from a checking account with a balance of $363,142.39!!!

So many questions. I don’t know any millionaires I could ask, but is it normal for wealthy people to keep several hundred thousand dollars in a plain old checking account? Maybe they need to be prepared if they decide to buy a house that day?

And, who could it have been? What very wealthy individual would have been in Duluth, shopping at Cub Foods and using that ATM at 4:22 p.m. today? I almost don’t want to know; the truth is almost certainly not as much fun as the stories that can be conjured up.

I’m looking at the receipt sitting on my desk as I type this. It’s just numbers on a slip of paper, but it feels so out of place in my humble little house.

Recommended Links:

Leave a Comment

Only registered members can post a comment , Login / Register Here

36 Comments

Cory Fechner

about 13 years agoreddomain

about 13 years agoHaley

about 13 years agoMildred

about 13 years agoBarrett Chase

about 13 years agoakjuneau

about 13 years agoTerry G.

about 13 years agoEthan

about 13 years agodrifter

about 13 years agoBarrett Chase

about 13 years agoEvilResident

about 13 years agojake

about 13 years agoNeed

about 13 years agoBad Cat!

about 13 years agoElden

about 13 years agoBC

about 13 years agoIron Oregon

about 13 years agoHaley

about 13 years agoMildred

about 13 years agoDonny Krosch

about 13 years agoEthan

about 13 years agoIron Oregon

about 13 years agoFitz

about 13 years agoNeed

about 13 years agoMildred

about 13 years agoEthan

about 13 years agoRae

about 13 years agoc-freak

about 13 years agoChris

about 13 years agoWaveview

about 13 years agoFrench

about 13 years agoandy

about 13 years agoThe Big E

about 13 years agoMildred

about 13 years agoBeastOfBurden

about 13 years agoJim

about 13 years ago